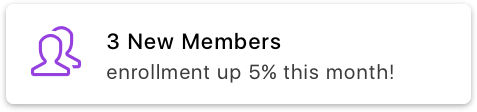

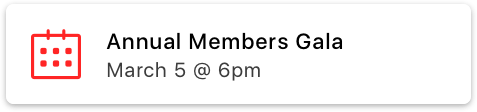

SilkStart's software simplifies membership and association management. Connect with your members like never before.

Easy

Manage and grow your member-based organization in the cloud

Modern

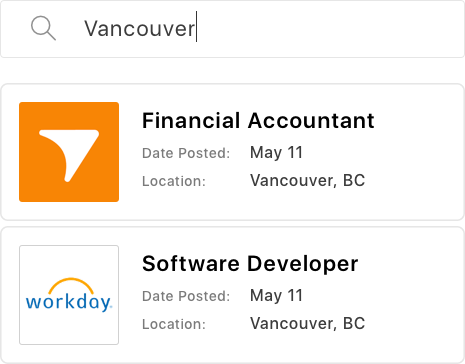

Delight your members with a simple interface that works on any device

Flexible

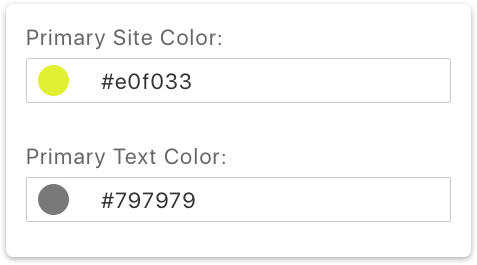

No two organizations are the same - your platform is tailored to your needs.